started their free check with & other lenders

Work from home tax claims has featured on

I found out about this service from a friend at work. She worked from home during Covid on and off like me as we work in the same department. Once I found out she got over £200 back I knew I should get roughly the same. She sent me the link to this site and they literally did everything for me. All I had to do was enter my details and upload my P60. Very easy. Very simple. I would highly recommend it to anyone!

Timothy Plumb, Devonshire

How do I know if I qualify for a claim?

You qualify for a claim if you worked from home during the 2020 - 21 and / or the 2021 - 22 tax year. You only had to work from home for at least 1 day in order to be eligible for a refund

Why do I need to upload my payslip / P60?

By uploading your payslip / P60 we can extract certain individual identifiers that are required for HMRC to process your claim, such as your PAYE reference number

How long does the process take?

There are a few factors that contribute to how long the process takes, such as how busy HMRC are and how quickly they're getting through the claims. Usually we see claims processed within 8-10 weeks

What's the maximum amount of money I can get?

The most HMRC will refund is £624, that's £312 for each tax year

Payslip / P60 upload instruction guide

Below are some guidelines of what is required for you to upload and how to do it

What is my payslip and where to find it?

Your payslip ensures that employees receive the correct pay and entitlements and help employers to keep accurate and complete records. Payslips are either given in paper form, or digitally, typically via email

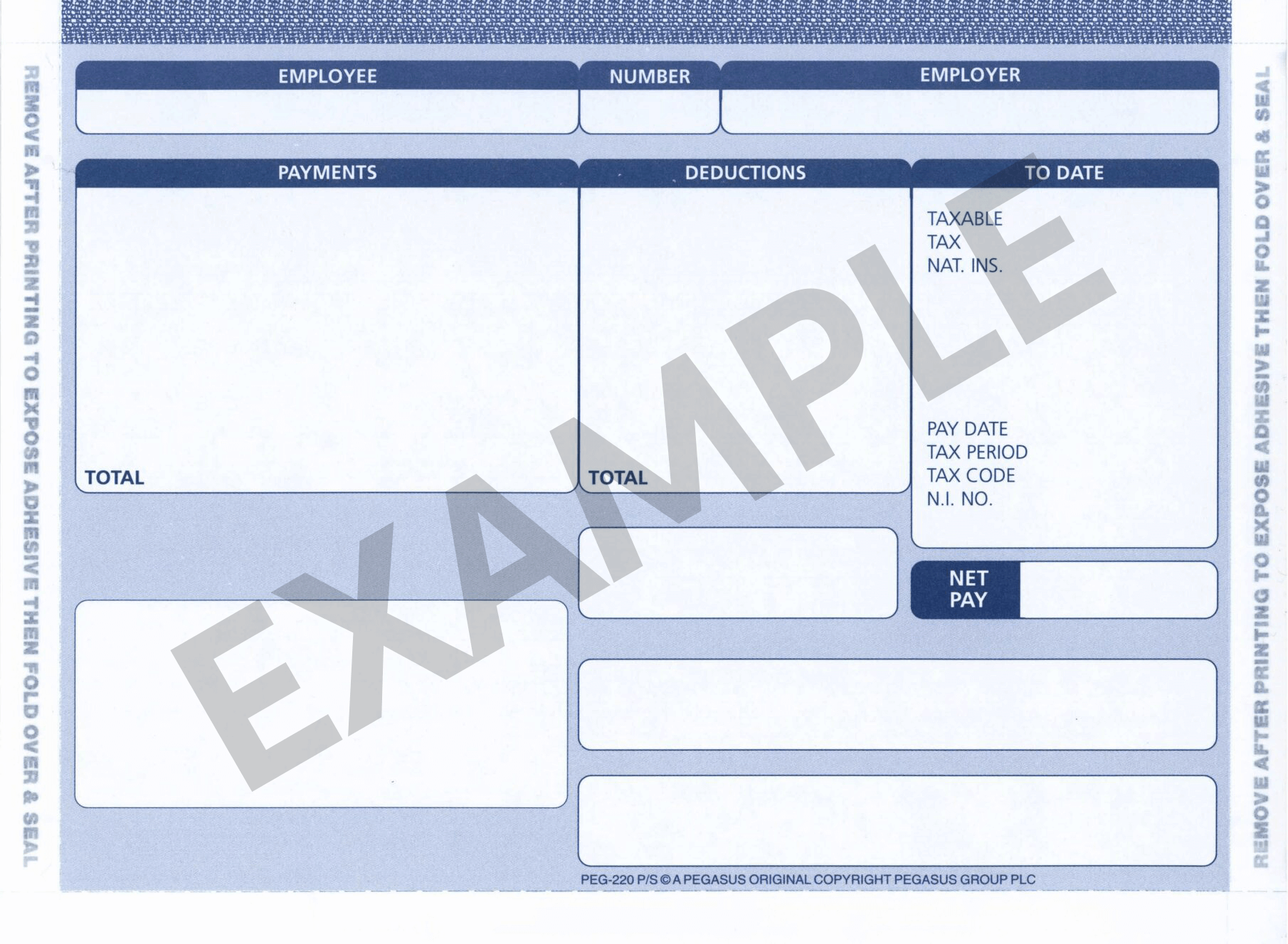

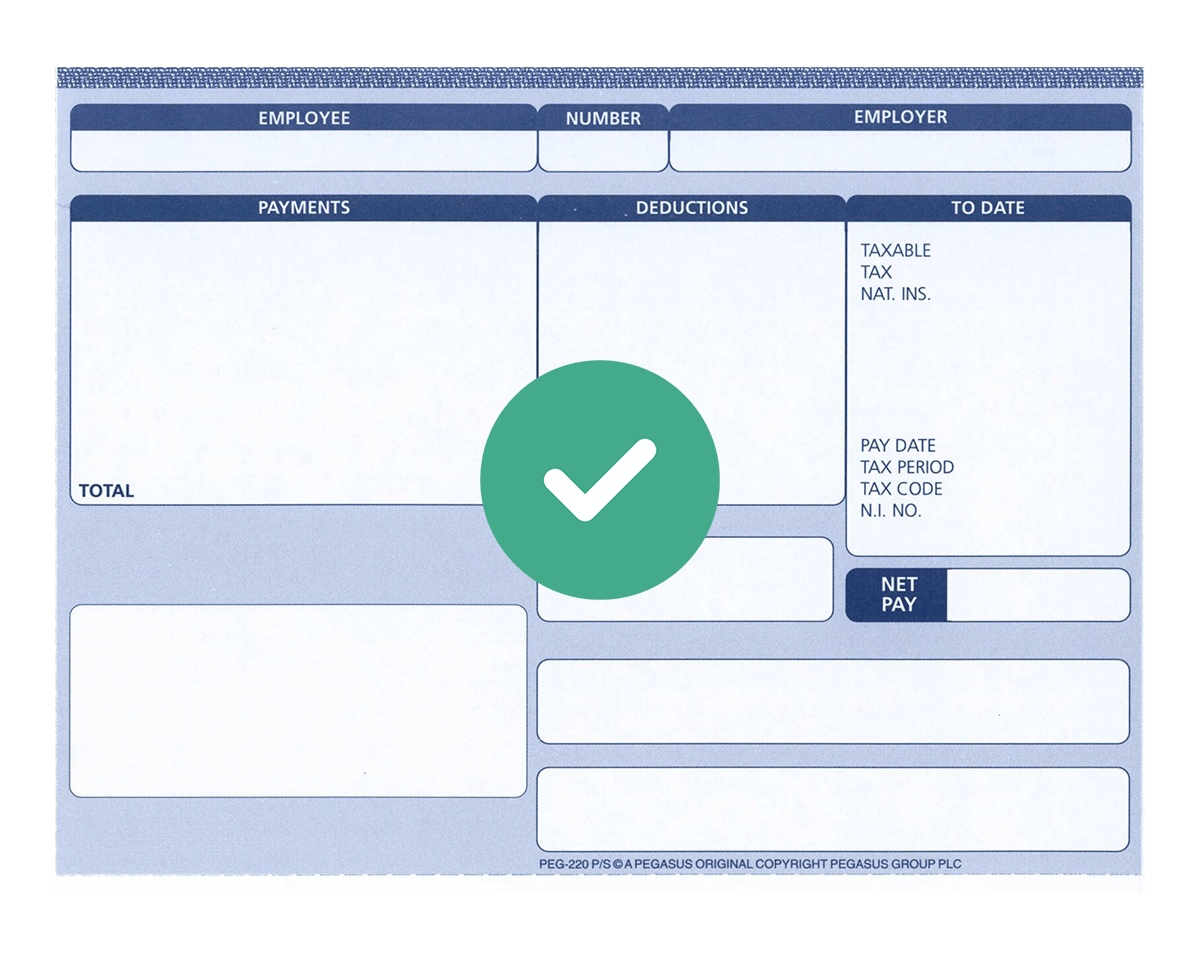

What does a payslip look like?

Payslips can vary in appearance, but they all typically have the same information on them. Here is an example of how a typical payslip may look:

What is my P60 and where to find it?

A P60 End of Year Certificate is a handy little piece of HMRC paperwork that shows how much you've been paid in a given tax year. Your employer will issue one of these to you in May of every year, whether it be a paper copy, or digital, typically sent via email

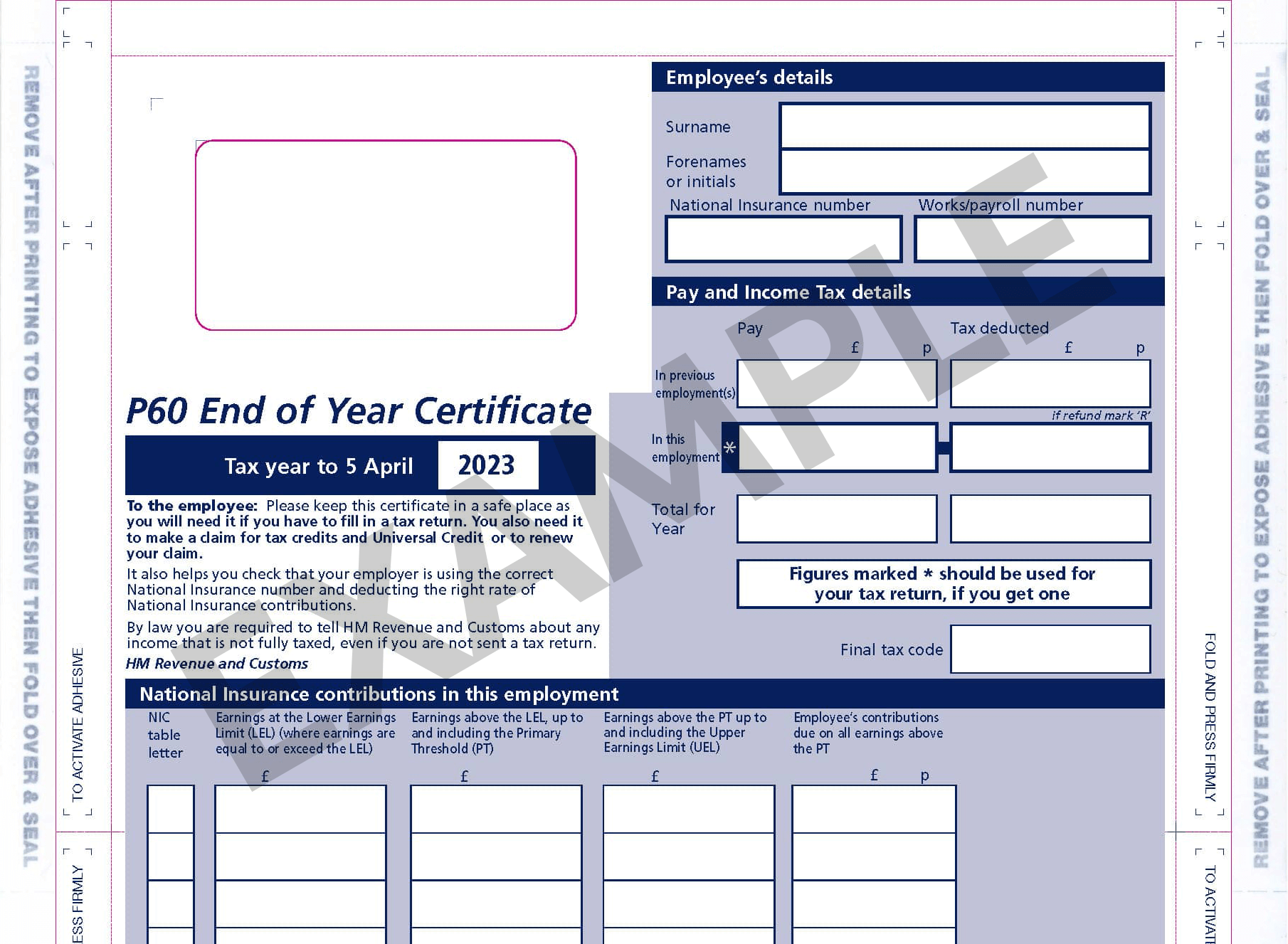

What does a payslip look like?

A P60, just like a payslip, can also vary in appearance, but they all follow a pretty standard layout. Here is an example of how a typical P60 may look:

How to take a photo of your P60 using our photo feature

If you are providing your payslip / P60 using our photo feature, you may be prompted by your browser to allow access to your camera. Simply allow this and you can go ahead and take a photo

Ensure the photo has all of the document in frame and all of the information is in good focus (not blurry)

Below are some examples of bad photos and then how a perfect photo should look:

Good

All of the document in frame, focused and clear

Bad

The whole of the document is not in frame

Bad

The document is blurry and information not clear

Capture a photo of your payslip or P60

Please ensure the photo has all of the document in frame and all of the information is in good focus (not blurry) before clicking 'Take photo'. This will only work if you have a webcam or a built in camera on your laptop

If you're still uncertain about what to do here, please follow our simple instruction guide by clicking here

Your information is 100% safe and secure on this website

Below are some examples of bad photos and then how a perfect photo should look:

Good

All of the document in frame, focused and clear

Bad

The whole of the document is not in frame

Bad

The document is blurry and information not clear

started their free check with & other lenders